What is an Integrated Client Accounting Services platform? To many accounting firms, this sounds more like an oxymoron than a reality.

Bookkeeping, client accounting, and reporting are core services that business managers, and a growing number of family office firms provide, along with bill pay. But too often firms must piece together disparate systems to meet their bill pay and accounting needs. This can mean using retail or small business products that were not designed for multi-client services or don’t integrate with other key multi-client systems. Firms are left with a disjointed technology solution that is not scalable and does not provide the transparency and controls they need.

To understand what an integrated client accounting services platform is, we first need to define what are ‘Client Accounting Services’ (CAS). As many family wealth firms look to expand their offering and provide more holistic solutions for their clients, they are increasingly adding services such as financial reporting, cash flow analysis, and bill payment. And for good reason; 62% of firms recently surveyed by AgilLink, say they provide bill pay because it adds stickiness to the relationship.

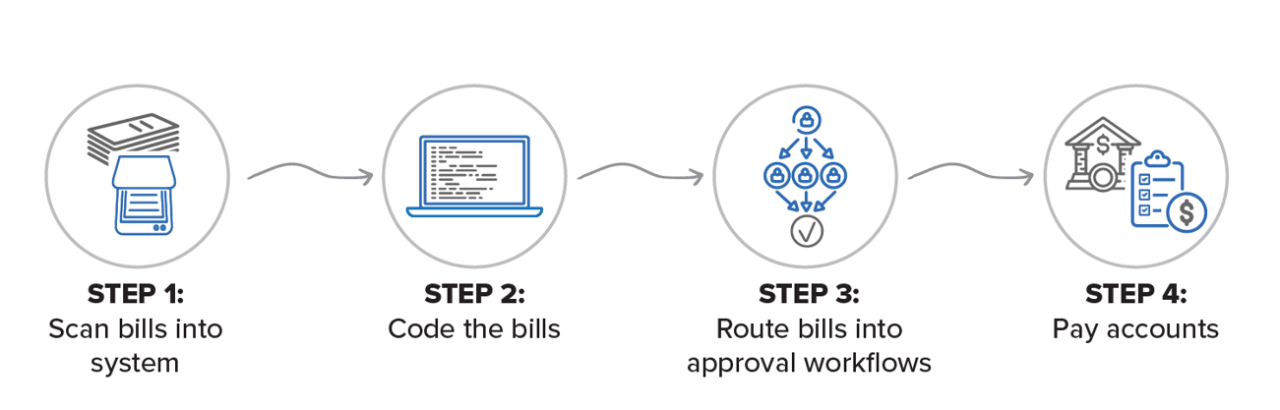

For firms to offer CAS efficiently the accounting and bill pay functions must be integrated into your technology platform. One way to look at it is that bill pay is the input and client accounting and cash flow analysis are the outputs. The problem for many firms is that the bill pay system is separate from the accounting system and offers no integration between the two. The accounting system is last to know about payment activity and it can be months before everything is accounted for and reconciled. The bookkeeper, not the technology, becomes the main conduit to both systems. This situation is compounded by the fact that many firms are using a consumer-based general ledger that is not multi-entity, requiring the bookkeeper to constantly log in and out of the various entities that your client owns. Your typical high net worth client will have multiple entities you need to track. Multiply these by dozens of clients and you can see how this type of environment quickly prevents you from scaling your business.

As firms move beyond offering bill pay on an ad hoc basis (or more accurately on an accidental basis) and progress to offering full service CAS, they need a solution that scales, provides transparency across clients, and offers the critical controls to properly manage this environment. Providing scale and adding more control may sound like competing priorities, but when an approval workflow is integrated with a multi-entity general ledger and a banking platform, it is possible to create scale while also gaining control and visibility.

Key Components of an Integrated Client Accounting Services Platform

There are five key components you should look for in a CAS technology solution.

They are:

- Integrated Document Imaging: It doesn’t sound like that big of a deal, but lack of integration with electronic documents was the number one pain point identified by AgilLink's recent market research survey. Having an electronic image of a bill that is part of the invoice payment approval process is a critical component to scaling to meet demand. It also makes audits and client inquiries much easier to manage when you can quickly point to a related image instead of trying to find the document on a file server. Integrated imaging saves time – period.

- Cloud Based Accounting: The accounting system is at the heart of your operations. Your accounting system needs to be in the cloud, making it accessible from anywhere you can access a browser. Another key aspect is having a multi-entity accounting system. Logging in and out of various client files is not scalable. Finally, your accounting solution needs to integrate with a bill payment system, which eliminates double entry of data. Dual data entry is death by a thousand journal entries.

- Approval Workflow: Having an integrated approval workflow is critical. Your system should support various approval workflows that may or may not include the end client. If the end client is involved, your process must be available on a mobile device. The approval workflow should act as a gatekeeper to the release of funds directly from the system. If it is separate, then funds can be released independent of the approval process - which makes it an "approval process" in name only.

- Integrated Treasury Management: At the end of the day your clients’ invoices need to be paid. Using a client’s bank account opens firms to all sorts of risk and it can be difficult to manage and predict how much cash will be on hand. Likewise, using a payment provider may leave you in the dark on when the actual invoice might get paid, and the information reporting is not integrated with your accounting system. When all payments are marked to the payment provider, how do you track what your client spent their money on?

- API Driven Ecosystem: Finally, client accounting is only one aspect of your service offering. You need your accounting and bill pay solution to be able to integrate into your larger technology stack. Does this system plug into your investment reporting system? Do your financial reports incorporate investment data in a streamlined manner? Your goal is to offer a holistic service to your clients, and to do this in an efficient and scalable manner you need the ability to securely integrate all of your technology components.

Want to learn more about how AgilLink stacks up? Please download this one pager.